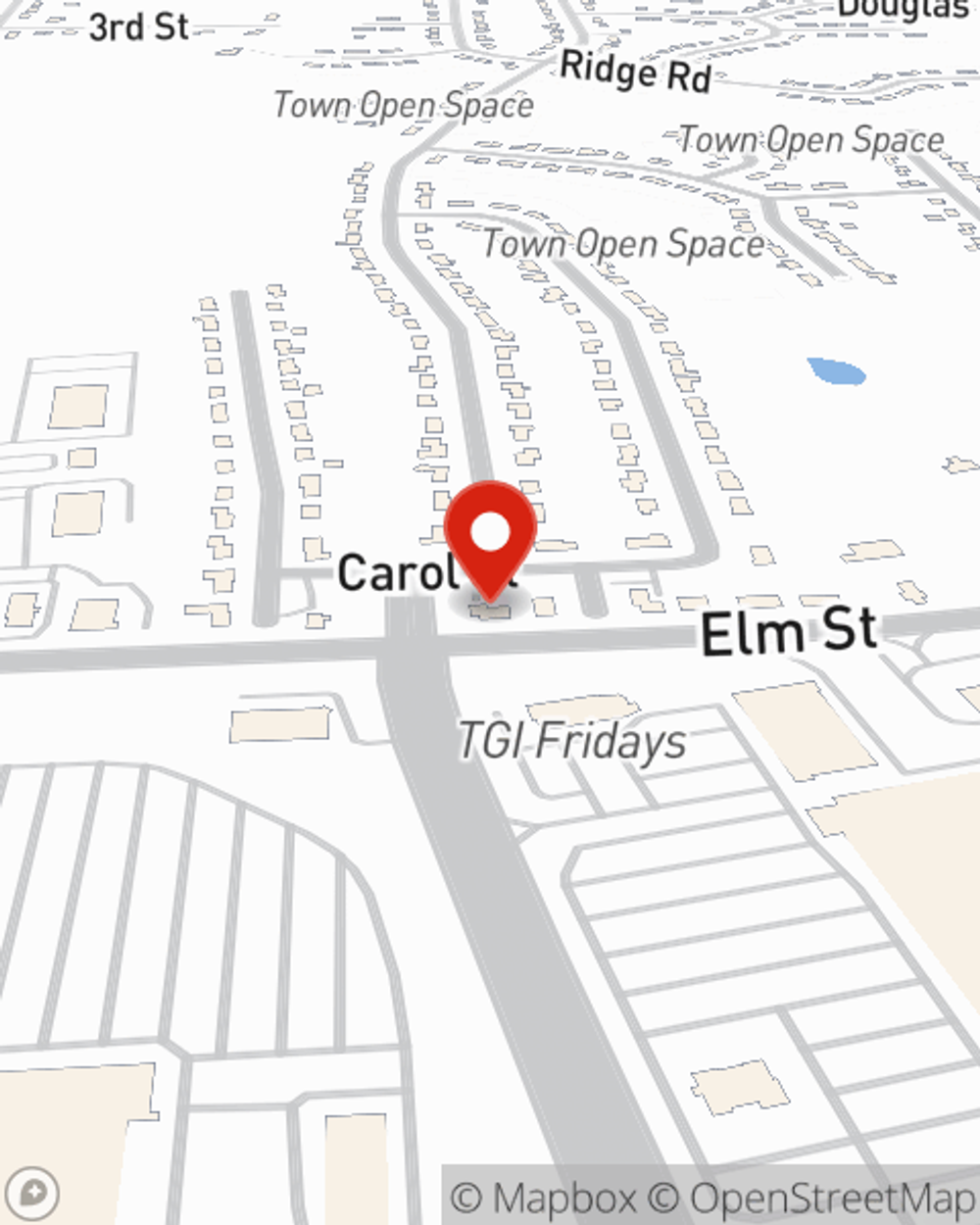

Condo Insurance in and around Enfield

Unlock great condo insurance in Enfield

Condo insurance that helps you check all the boxes

Home Is Where Your Heart Is

You have plenty of options when it comes to choosing a condominium unitowners insurance provider in Enfield. Sorting through savings options and coverage options is a lot to deal with. But if you want great priced condo unitowners insurance, choose State Farm for covering your condo and personal belongings. Your friends and neighbors in Enfield enjoy incredible value and straightforward service by working with State Farm Agent Jo Ann Walk. That’s because Jo Ann Walk can walk you through the whole insurance process, step by step, to help ensure you have coverage for your condo as well as videogame systems, swing sets, clothing, souvenirs, and more!

Unlock great condo insurance in Enfield

Condo insurance that helps you check all the boxes

Safeguard Your Greatest Asset

It's no secret that life is full of surprises, which is all the more reason to be prepared for the unexpected with condo unitowners insurance. This can include instances of liability or covered damage to your condo unit from water damage, vandalism or a windstorm.

That’s why your friends and neighbors in Enfield turn to State Farm Agent Jo Ann Walk. Jo Ann Walk can outline your liabilities and help you find a policy that fits your needs.

Have More Questions About Condo Unitowners Insurance?

Call Jo Ann at (860) 745-6500 or visit our FAQ page.

Simple Insights®

What is individual liability insurance and what does it cover?

What is individual liability insurance and what does it cover?

Liability insurance is typically a portion of the coverage for a home or vehicle policy. A Personal Liability Umbrella Policy may be another viable option for further protection.

How to deal with noisy neighbors or issues

How to deal with noisy neighbors or issues

From noisy neighbors and arguments over property lines to adventurous pets, there are ways to successfully resolve disputes between neighbors.

Jo Ann Walk

State Farm® Insurance AgentSimple Insights®

What is individual liability insurance and what does it cover?

What is individual liability insurance and what does it cover?

Liability insurance is typically a portion of the coverage for a home or vehicle policy. A Personal Liability Umbrella Policy may be another viable option for further protection.

How to deal with noisy neighbors or issues

How to deal with noisy neighbors or issues

From noisy neighbors and arguments over property lines to adventurous pets, there are ways to successfully resolve disputes between neighbors.